11

Aug

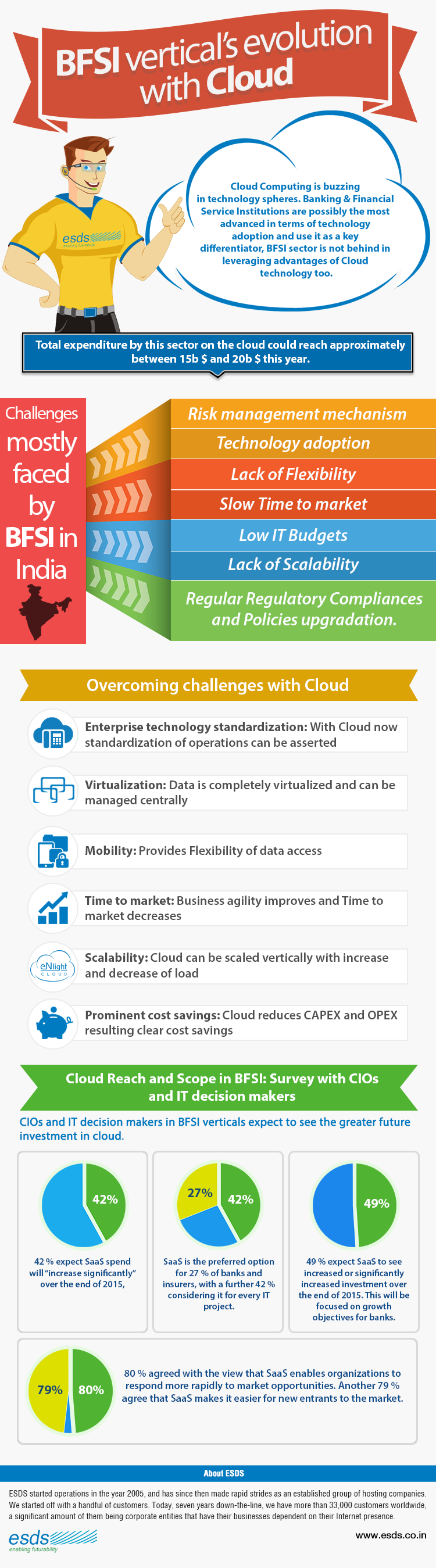

BFSI vertical’s evolution with Cloud

BFSI vertical’s evolution with Cloud

Cloud Computing is buzzing in technology spheres. Banking & Financial Service Institutions are possibly the most advanced in terms of technology adoption and use it as a key differentiator, BFSI sector is not behind in leveraging advantages of Cloud technology too.

Total expenditure by this sector on the cloud could reach approximately between 15b $ and 20b $ this year.

Challenges mostly faced by BFSI in India

- Risk management mechanism

- Technology adoption

- Lack of Flexibility

- Slow Time to market

- Low IT Budgets

- Lack of Scalability

- Regular Regulatory Compliances and Policies upgradation.

Overcoming challenges with Cloud

- Enterprise technology standardization : With Cloud now standardization of operations can be asserted

- Virtualization: Data is completely virtualized and can be managed centrally

- Mobility: Provides Flexibility of data access

- Time to market : Business agility improves and Time to market decreases

- Scalability : Cloud can be scaled vertically with increase and decrease of load

- Prominent cost savings : Cloud reduces CAPEX and OPEX resulting clear cost savings

Cloud Reach and Scope in BFSI: Survey with CIOs and IT decision makers

CIOs and IT decision makers in BFSI verticals expect to see the greater future investment in cloud.

- 42 % expect SaaS spend will “increase significantly” over the end of 2015,

- SaaS is the preferred option for 27 % of banks and insurers, with a further 42 % considering it for every IT project.

- 49 % expect SaaS to see increased or significantly increased investment over the end of 2015. This will be focused on growth objectives for banks.

- 80 % agreed with the view that SaaS enables organizations to respond more rapidly to market opportunities. Another 79 % agree that SaaS makes it easier for new entrants to the market.

Latest posts by Vaishnavi Kulkarni (see all)

- Embrace the Future with Cloud Computing! - September 8, 2015

- Cloud computing impact on growth of ecommerce applications - August 25, 2015

- 6 Reasons that Cloud Computing is transforming Banking Sector - August 24, 2015