How AI and Machine Learning Reinvigorate the Insurance Industry

Like every other industry, data has also been the core of the insurance industry. Over the due course of time, what actually has changed is the amount of data and the speed at which machines are processing it for driving useful insights. Data-driven insights play a vital role in boosting this industry by making decisions based on facts, figures, and user patterns. Insurance providers adopt Artificial Intelligence (AI) & Machine Learning (ML) technologies to enhance the end-user experience, develop improved solutions for increasing operational efficiency, and build accurate underwriting models.

Defining Machine Learning

Machine Learning is an application of Artificial Intelligence technology that allows computer systems to deploy algorithms for learning and improving my experience. Such algorithms are used for building mathematical models which can be used as training data, allowing systems to make decisions & predictions.

AI & ML in Insurance Industry

AI and ML technologies make it easier for insurance providers to use the data at their desired pace and way. Many organizations in this industry have access to data that is usually structured and stored in databases. Driving insights out of unstructured data is becoming a major challenge for insurance providers. However, AI & ML technologies offer a lucrative opportunity to the insurance industry for gaining timely and actionable insights out of both- structured and unstructured data.

How AI Technology is Transforming Insurance Industry

Following are some core areas where Artificial Intelligence Technology is playing a significant role in transforming the Insurance Industry-

- Improved Customer Service

The insurance industry is extensively using chatbots developed by Top AI companies to resolve customer queries round-the-clock. Besides resolving queries, these bots are also used for handling customer complaints and grievances, customer quotes, etc. These bots can be easily integrated across channels like websites, social media platforms to engage more customers through their desired communication platforms.

- Fraud Detection and Prevention

As per an online international report, the insurance sector incurs about $40 billion as the total insurance fraud cost. By adopting AI & ML technologies, the insurance providers can deeply analyze historical data and determine patterns that can be used beforehand to detect frauds at the early stages.

Deep Anomaly Detection is a well-established ML application that is used for detecting frauds. By analyzing large data volumes, AI technology-based software is being used for creating insurance claims models. Any difference in the traditional claims is marked as fraud, allowing insurance companies to cut down costs associated with frauds and gain superior results.

- Better Management of Claims

Claims Management is an indispensable component of the insurance industry; however, it can be tiring. Setting a claim includes processing huge data volumes and interacting with stakeholders. AI technology applications can be used to automate critical processes like routine data checks and interactions and free up the insurance providers to make sure they focus on essential tasks.

Another significant benefit of using ML applications in claims management includes the enhanced security of customers’ data. With such advanced technologies in place, insurance companies can make the claim management process faster and smoother.

- Easy Handling of Risk Management

Predicting premiums and losses for policies is one of the common problems that insurers face. When risks are identified pre-hand, they can create plans that take action before a risk takes place. Risks identified through Machine Learning are helping the insurance sector by accurately using the time of underwriters, hence making the entire process less complicated. Machine Learning also helps get detailed insights into emerging frauds, credit-linked risks, and changing regulations. The insurance team can detect credit risks highly accurately through rich analytics and pattern prediction capabilities.

- Adherence to Regulatory Compliances

The regulatory and compliance system of the insurance industry is considered to be complex and highly dynamic. A significant challenge that insurance companies incur is keeping up with the regulations and incorporating the changes to policies. Policies like GDPR and Data Localization demand increased data protection and privacy for insurers. NLP technologies can help scan internal policies and claims documents and verify their compliance with multiple regulations.

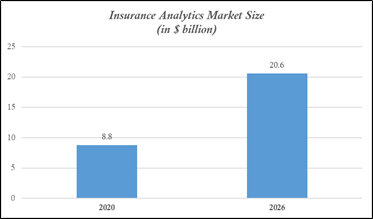

- Insurance Analytics Market

The global insurance analytics market is predicted to reach $20.6 billion by 2026, rising from $8.8 billion in 2020. During the forecasted period, this market will grow at a CAGR of 15.1%.

This market growth is attributed mainly to the increased focus on enhancing the end-user experience and the growing digitalization trend. However, evolving cyberattacks and their related threats can hinder this market’s growth.

Concluding Words

The insurance industry is already involving and with the introduction of Artificial Intelligence and Machine Learning technologies, insurers can definitely provide more personalized solutions. These solutions are also helping the insurance companies to stay ahead of their competitors through increased work efficiency and productivity.

- Considering Data Centers in India to Overcome Economic Conditions - May 10, 2022

- Determining Why Your Organization Needs Web Application Security - February 11, 2022

- How Does a Business Benefit with Managed Services - January 21, 2022