Why Banks Need SOC-as-a-Service Provider in their Team?

The financial services industry is one of the most risk-averse and sensitive industries. It’s also one of the most regulated. Banks have to follow specific rules and regulations set by regulators and auditors to ensure a safe, secure ecosystem. In this blog, we explore the need for SOC as a Service for banks.

What is SOC?

A security operations center (SOC) is an environment where security operations personnel monitor and control systems to protect an organization’s assets. It is a central hub where critical security events and activities are managed and monitored by an operations team. SOCs are designed to handle a variety of threats and situations, including network attacks, computer break-ins, and human error.

SOCs have evolved over time from a more centralized model to a distributed model that is distributed across the globe. The distributed model helps organizations optimize the use of existing security resources by distributing SOC teams across different regions.

SOC-as-a-Service

SOC as a Service is a cloud-based model where the vendor hosts the SOC infrastructure and supports SOC operations. Companies that provide SOC as a service are also known as SOC-as-a-Service providers. Organizations that want to set up a SOC can use a SOC as a service model. This model eliminates the need to invest in hardware and software and allows companies to focus on SOC operations.

Why Banks Need SOC-as-a-Service

Information contained in banks is among the most sensitive anywhere, and when handled incorrectly, it can result in significant monetary losses and long-lasting reputational damage.

According to an IBM report, financial breaches cost $5.72 million, the second-highest cost out of all sectors. The incident was caused by failing to follow security protocols for several months and failing to fix a widely known vulnerability in their systems.

SOC for banks makes them compliant with specific regulations enhancing customer trust. An organization that is compliant is much less likely to suffer from a data breach and the substantial costs associated with it. In addition, its brand reputation and equity will also be much better than those of non-SOC companies. The result? If you’re a financial institution or fintech company, SOC compliance will increase your business.

Additionally, with SOC-as-a-service, banks can focus on maintaining core banking operations and IT operations while outsourcing their SOC operations.

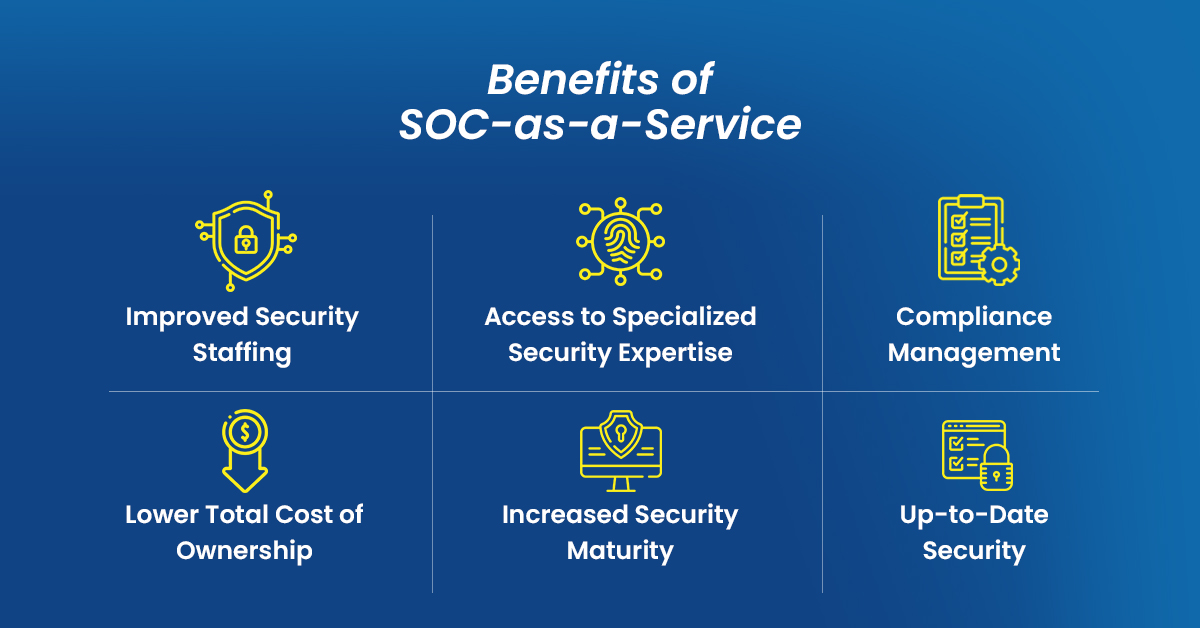

Benefits of SOC-as-a-Service

- Improved Security Staffing

Organizations struggle to attract and retain skilled security personnel due to the ongoing shortage of cybersecurity skills. Having a SOC-as-a-service provider on board allows an organization to supplement and fill gaps in its existing security team.

- 24/7 monitoring of security events

With SOC-as-a-service providers, organizations can keep track of security events and incidents through informative dashboards. Managed SOC services to reduce security teams’ workload and automate threat detection and response. It provides visibility in a single pane of glass with 24×7 monitoring of security events.

- Compliance Management

As banks hold the most sensitive data, it is mandatory for banks to follow certain regulations and compliance. Having a SOC-as-a-Service provider will help banks comply with the required regulations.

- Lower Total Cost of Ownership

It can be costly to deploy, run, and operate a complete SOC internally. Organizations can split the cost of hardware, licensing, and payroll with the other clients of their provider when using a managed SOC. As a result, robust cybersecurity requires less money for both capital and operational expenses (CapEx/OpEx).

- Increased Security Maturity

It takes time to develop the institutional knowledge and solutions for a mature cybersecurity program. By giving an organization access to their provider’s current solution stack and security specialists, partnering with a SOC-as-a-Service provider can assist in expediting this process.

- Improved scalability and automated threat detection

With the use of the cloud, the Internet of Things, and the remote workforce, organizations are growing swiftly. The outsourced cloud-based SOC service is a scalable answer to suit an organization’s requirements. A threat intelligence platform is used by SOC-as-a-Service providers to automate the threat detection process and offer context for incidents. These service providers can share alerts with assigned actions in real-time, thanks to automation.

- Up-to-Date Security

When an organization’s IT, and security budget is constrained, staying current with the newest SOC technologies and capabilities can be challenging. On the other hand, a managed SOC provider has the scale required to maintain its current toolkit and offers its clients the advantages of cutting-edge security.

Conclusion

As we explained earlier, SOC has evolved over time from a more centralized model to a distributed model that is distributed across the globe. The distributed model helps organizations optimize the use of existing security resources by distributing SOC teams across different regions. This model is used widely by banks and financial institutions because of their regulatory and compliance needs.

Your organization needs SOC-as-a-Service to be safe and secure. With ESDS service, you’ll be able to quickly and easily detect and respond to threats. We’ll also provide you with the latest security intelligence so you can stay one step ahead of the bad guys.

- Top 5 Data Center Trends for 2024 - October 11, 2023

- Top 15 Cloud Computing Trends 2024 - October 4, 2023

- What is Infrastructure Monitoring and Why Infrastructure Monitoring Tool is Important for Your Business? - September 20, 2023