Blockchain Technology- a Silver Lining to BFSI Industry

The rise of blockchain technology in 2008

revolutionised different industrial sectors. Blockchain is a game-changer for

all the industrial sectors, and companies cannot afford to ignore it. It is

considered to be the ground-breaking innovation of the internet era. A major

breakthrough in information storage and transmission, blockchain is likely to

transform the existing operating models of the BFSI industry.

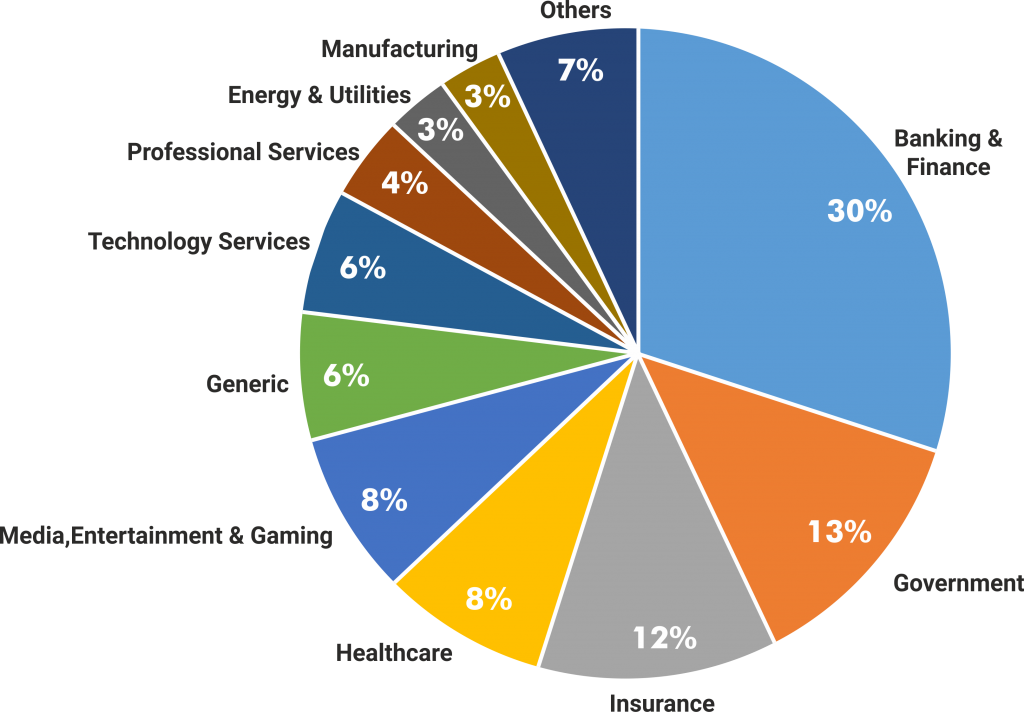

The technology experts Dr Garrick Hileman & Michel Rauchs in 2017 surveyed 132 use cases of blockchain technology and grouped them into different industry segments. The below pie chart depicts the percentage share of blockchain technology in various industries. BFSI industry has the most extensive set of use cases with a share of 30%.

The blockchain technology has found its way into the banking sector. A survey report from 2018 says 69% of Indian banks are experimenting blockchain.

Let’s have a look at how blockchain is making a dent in the BFSI sector.

1. Reduced Fraud

A cybercrime data says 45% of the banking and finance sectors suffer from financial crime annually. Blockchain being a new technology, it’s potential to reduce frauds is commendable. It has gained popularity across financial intermediaries like stock exchange and money transfer services. Currently, the BFSI industry has implemented centralised databases that are vulnerable to cyber-attacks as a single point of failure. A secure system to avoid such attacks is crucial for the BFSI industry, enabling safe transactions.

Operating on a distributed database system, blockchain is more secure and reliable technology, eliminating single point of failure. It stores every transaction in the form of a block using a cryptographic mechanism. These blocks are linked to each other simplifying the technique of tracking a security breach. In other words, a security breach in a single block affects the other blocks connected to it, enabling a secure system to eliminate cyber-attacks.

2. Smart Contracts

A smart contract is a self-executable piece of code, which runs when conditions written on it are met. Smart contracts speed-up and simplify complex processes of financial transactions, ensuring accurate information transfer. Smart contracts are generally used for non-disclosure agreements enforcing the obligations of all parties.

Blockchain reduces the room for error in financial transactions ensuring transparency of terms between all the parties.

3. Syndicated Loans

The loan market faces several regulatory requirements and challenges like KYC (know your customer), AML (anti-money laundering) and data protection rules that might potentially prevent growth. Blockchain benefits syndicated loan market through its distributed records enabling business growth. It offers a unique value proposition to banks planning for global expansion.

Based on the real-time system, Blockchain seamlessly tracks services and compliances. Blockchain’s distributed record technology enables banks to link the distributed tasks to a single customer block. This reduces the compliance costs since banks can benefit from compliances already completed in the syndicate.

4. Investment banking

Blockchain continues to march at the forefront of investment banking success simplifying back-office operations. The investment banks are ramping up their efforts to implement the Blockchain technology, reducing the costs faced due to data reconciliation. The applications of Blockchain technology in investment banking space include enhanced efficiency and transparency about KYC/AML data sharing, management of collateral, regulatory oversight and security trading.

Investment banks perform their own “Know Your Customer” (KYC) checks according to the specified jurisdictions. The technology uses a shared-client database to invite previously-KYC-validated investors on-board. Blockchain can improve regulatory control and eliminate unnecessary intermediaries, ensuring improved data quality and a high level of accountability.

5. Know Your Customer (KYC)

Customer accounts are flagged in case of suspicious banking transactions and reviewed by the bank head office under the Enhanced Due Diligence (EDD) process. Every year millions of individuals report themselves as a victim of identity theft. According to a survey, identity theft causes banks to lose $15 billion to $20 billion annually.

Blockchain is a potential solution to protect customer data and prevent frauds and money laundering. The decentralised Blockchain structure eliminates the risk of a central server to store and maintain records. The customer data is safe from single-point failures. Blockchain enables an individual to take charge of information tied to their identity and add accessibility permissions.

Conclusion: Blockchain has already started reshaping the BFSI industry. Recognising the potential of Blockchain technology, the big giants in the BFSI industry have already begun conducting tests to find out its possible use cases. Blockchain in BFSI has made the system more transparent, easy to access and reliable.

- Digital Transformation Paves the Way for the Finance Industry - July 29, 2021

- Embracing Change – How Banks are Adopting Digital Innovation - April 19, 2021

- How the Indian Education Sector is Embracing Cloud Computing - November 13, 2020