Why the BFSI Industry Needs GPUaaS Now

TL;DR (Quick Summary) – The BFSI industry is rapidly adopting GPU-as-a-Service (GPUaaS) to power AI-driven fraud detection, risk modeling, customer analytics, and regulatory compliance. With on-demand GPU scalability, reduced costs, and built-in security, GPUaaS enables banks and financial institutions to accelerate digital transformation while meeting strict performance and compliance requirements.

What Is a GPU-as-a-Service Platform?

GPU-as-a-Service (GaaS) is a cloud infrastructure offering on-demand access to high-powered Graphics Processing Units (GPUs) without the need for the enterprise to acquire or maintain high-cost hardware. Within the Banking, Financial Services, and Insurance (BFSI) industry, where there is demand for real-time analysis, fraud prevention, and AI-driven decision-making, GaaS allows institutions to leverage high-powered computation on demand and cost-effectively.

Instead of using expensive GPU clusters and hosting them internally, BFSI institutions are taking advantage of a secure, scalable, and pay-per-use solution to speed up workloads including risk modelling, algorithmic trading, and customer service. (source). Adoption of AI in banking and finance is one of the biggest movers in the global GPUaaS market, which is expected to reach $26.62 billion by 2030. (source)

What Are the Critical Workloads in BFSI That Require GPU Acceleration?

BFSI organizations process many mission-critical workloads that require heavy computational power. BFSI GPU use cases are important to understand, as these workloads have grown in complexity with digital transformation, necessitating advanced processing capabilities that traditional CPUs are unable to efficiently process.

Primary GPU-Intensive Workloads in BFSI:

- Real-time Fraud Detection and Prevention

- High-Frequency Trading (HFT) and Algorithmic Trading

- Risk Evaluation and Credit Scoring Models

- Regulatory Compliance and Anti-Money Laundering (AML)

- Customer Behaviour Analytics and Personalization

- Stress Testing and Monte Carlo Simulations

- Natural Language Processing for Document Analysis

- Computer Vision for Check Processing and KYC Verification

Such workloads demand parallel processing capability where GPUs shine, and hence GPU-as-a-Service becomes a critical infrastructure building block for BFSI operations in the future. Commercial banks of large sizes to co-operative banks using AI, organizations at all levels of the financial sector are beginning to appreciate the revolutionary potential of GPU acceleration. (source)

How Does Real-Time Fraud Detection Benefit from GPU Acceleration?

Real-time fraud detection products process millions of transactions per second, examining sophisticated patterns and anomalies that could indicate fraudulent activity. GPU acceleration transforms this critical security function in several ways:

Key Benefits for Fraud Detection:

- Millisecond Response Times: GPU parallel processing makes sub-second transaction analysis feasible.

- Pattern Recognition: Highly advanced machine learning algorithms are able to identify subtle indications of fraud

- Scalable Processing: Process large volumes of transactions during peak traffic season

- Continuous Learning: Continuously updated models through learning from new fraud trends emerging in real-time

Faster-than-real-time fraud detection systems employ machine learning algorithms that require large-scale parallel processing to compare patterns of transactions, user behavior, and indicators of risk with one another on multiple dimensions.

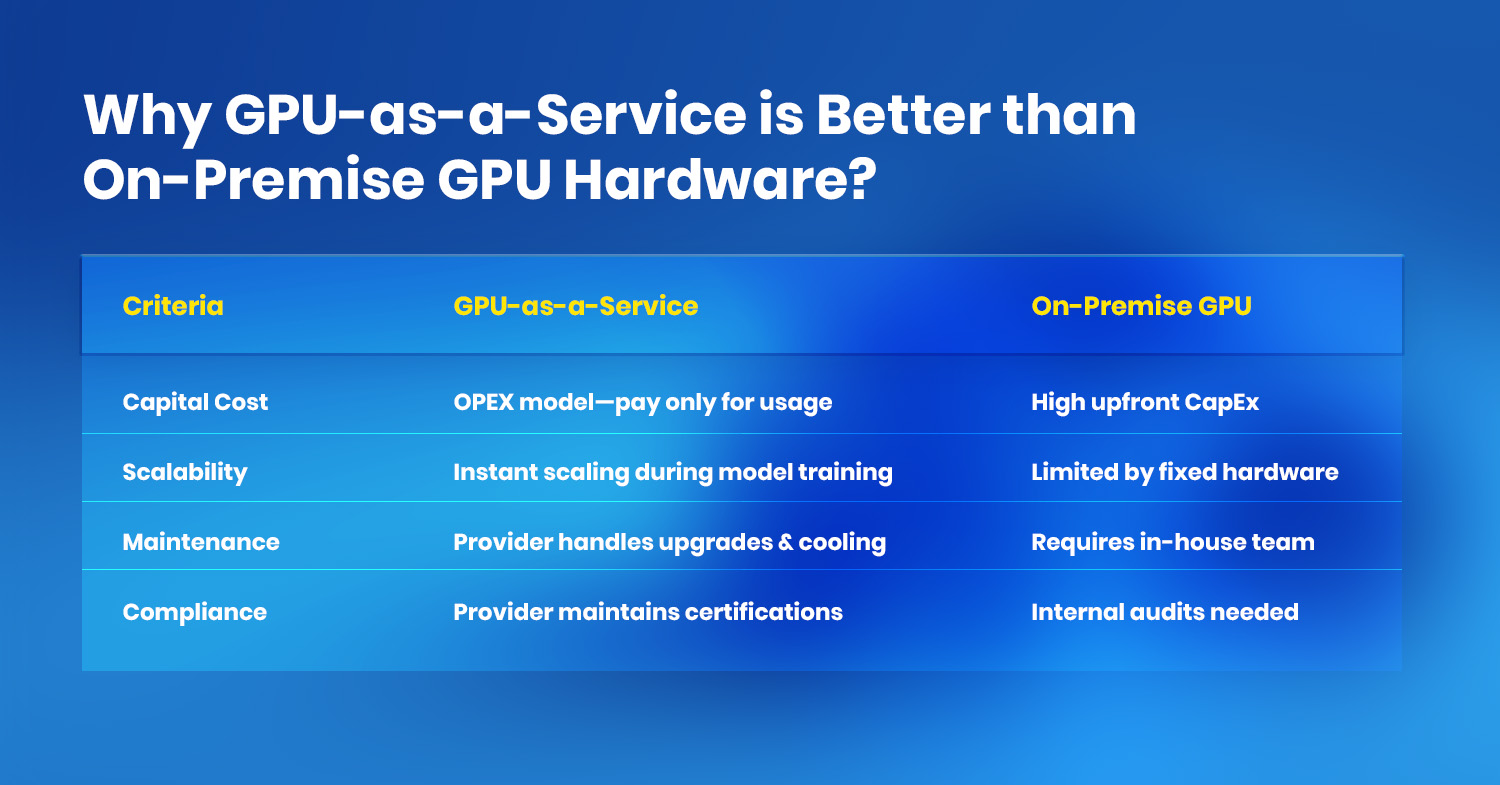

Why GPU-as-a-Service is Better than On-Premise GPU Hardware?

GPUaaS provides flexibility, cost-effectiveness, and built-in compliance that on-premise hardware does not.

| Criteria | GPU-as-a-Service | On-Premise GPU |

| Capital Cost | OPEX model—pay only for usage | High upfront CapEx |

| Scalability | Instant scaling during model training | Limited by fixed hardware |

| Maintenance | Provider handles upgrades & cooling | Requires in-house team |

| Compliance | Provider maintains certifications | Internal audits needed |

How does GPU-as-a-Service facilitate AI in Co-operative banks?

Co-operative banks may not have the budget for special AI infrastructure. GaaS fills the gap by:

1. Providing shared pools of GPUs for training AI models at a fraction of the expense.

2. Facilitating predictive analytics for credit risk and loan defaults.

3. Enabling voice banking and chatbots to improve customer service.

This places them on the same level, allowing co-operative banks to compete with big public- and private-sector banks.

What Security and Compliance Benefits Does GPUaaS provide BFSI?

BFSI organizations need deep data analysis as well as reporting that is mandatory for strict regulation. GPU-as-a-Service enables compliance by:

Compliance Benefits:

- AML Transaction Monitoring: track patterns of transactions for suspicious activity.

- GDPR Data Processing: Processing large-scale anonymization of data effectively

- Basel III Calculations: Complex risk-weighted asset calculations

- MiFID II Reporting: Real-time trade reporting and best execution analysis

The computer processing complexity of modern compliance requirements has grown exponentially, with regulations requiring more sophisticated analysis and reduced reporting timelines. (source)

What Deployment models fit BFSI requirements?

Banks and insurers are using:

- Public GPU Cloud – Fast deployment for AI innovation

- Private GPU Cloud – Dedicated resources for high-value applications

- Hybrid GPU Cloud – Merging private security with public scalability

How does GPUaaS drive digital transformation?

AI-powered banking requires fast experimentation and deployment in a continuous manner:

- Instant scaling through model training cycles.

- Deployment of tailored financial products.

- Smooth integration with fintech platforms and real-time payments.

McKinsey says that AI that can be unleashed in global banking through to 2030 at USD 1 trillion. GPUaaS is among the major enablers of this. (source)

What is the Cost–Benefit Highlights?

The cost implications of GPU infrastructure investments bear significant effects on BFSI organizations’ profitability and operational effectiveness.

Cost Comparison Analysis:

On-Premises GPU Infrastructure:

- Heavy initial capital outlay ($50,000-$200,000 per high-end GPU server) (source)

- Regular maintenance and upgrade expenses

- Unused resources during off-peak times

- Need for dedicated IT personnel

GPU-as-a-Service Benefits:

- pay-per-use model reduces large capital outlays

- Automatic scaling maximizes resource utilization

- No maintenance overhead – vendor takes care of all infrastructure needs

- access to latest hardware without procurement lead times

Industry analysis indicates that GPU-as-a-Service can cut total cost of ownership by 40-60% over on-premises implementations, especially for organizations with fluctuating workloads or insufficient in-house GPU skills. This cost advantage has made high-end GPU infra banking capacity available to smaller regional banks and credit unions so that they can keep pace with large institutions in terms of technology sophistication. (source)

How to Select the Right GPU-as-a-Service Provider for BFSI Requirements?

Selecting an appropriate GPU-as-a-Service provider requires evaluation of some important factors pertinent to BFSI requirements:

Key Selection Criteria:

- Regulatory Compliance: Provider must comply with financial services regulations

- Performance Guarantees: SLA guarantees on latency and availability

- Security features: Advanced security features and certifications

- Scalability Options: Ability to handle dynamic workload requirements

- Technical Support: 24 x 7 technical support with financial services expertise

Industry analysts note the importance of rigorous testing processes including proof-of-concept testing, reference customer interviews, and rigorous security review before making provider procurement decisions.

People Also Ask

What is the difference between GPU-as-a-Service and traditional cloud computing?

GPU-as-a-Service itself offers exposure to graphics processing units that are tailored for parallelized computing operations, whereas standard cloud computing is based on CPU-oriented virtual machines. GPUs are more robust in handling thousands of parallel computations and, thus, best fit for machine learning, AI, and high-end mathematical modeling applied in BFSI.

What does GPU-as-a-Service do with data sovereignty and privacy needs?

GPU-as-a-Service vendors provide data localization features and private cloud deployment to meet strict regulatory requirements. Data can be processed within defined geographical regions, and private instances provide complete isolation from all other tenants.

Can GPUaaS meet Indian data-localization norms?

MeitY-empaneled data center vendors such as ESDS make provisions for BFSI data to remain in India.

How quickly can GPU capacity be scaled?

Capacity is typically provisioned in minutes, wiping out multi-week hardware lead times.

Final Word: ESDS Advantage in GPU-as-a-Service

BFSI industry is quickly transitioning to AI-based banking services, and GPU-as-a-Service has emerged as the cornerstone of this transition. From fraud detection in large private banks to AI-based co-operative banks, the demand for GPU banking infrastructure will continue to rise as processes become more complex and real-time decision-making an imperative of competition.

For enterprises seeking secure, compliant, and cost-optimized GPU deployment, ESDS offers MeitY-empaneled, BFSI-ready GPU-as-a-Service platform, offering data sovereignty, regulatory compliance, and aims to give high-performance compute for the critical workloads that define the future of financial services.

“ESDS Software Solution Limited is proposing, subject to receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its equity shares and has filed a draft red herring prospectus (“DRHP”) with the Securities and Exchange Board of India (“SEBI”) that is available on the website of the Company at https://www.esds.co.in/, the website of SEBI at www.sebi.gov.in as well as on the websites of the book running lead managers, DAM Capital Advisors Limited at https://www.damcapital.in/ and Systematix Corporate Services Limited at http://www.systematixgroup.in/ The website of the National Stock Exchange of India Limited at www.nseindia.com and the website of the BSE Limited at www.bseindia.com, respectively. Investors should note that investment in equity shares involves a high degree of risk. For details, potential investors should refer to the RHP which may be filed with the Registrar of Companies, Maharashtra at Mumbai, in future including the section titled “Risk Factors”. Potential investors should not rely on the DRHP filed with SEBI in making any investment decision.”

- Why the BFSI Industry Needs GPUaaS Now - October 31, 2025

- The Future of VAPT Services: AI, Bug Bounties, and Beyond - June 20, 2025

- Government Community Cloud: The Backbone of Modern Public Infrastructure - April 7, 2025